Author’s note: the morning this piece was published, Late Apex Partners released its own Vail Resorts letter and excellent slide deck.

For the 2024/2025 season, Vail experienced its first ever year-over-year decline in Epic Pass product* units sold. This is despite taking a 20% price cut in 2021/2022 (prices are now equivalent to the 2020/2021 season’s) and the company’s target demographic (higher income consumers) being in general good economic health.

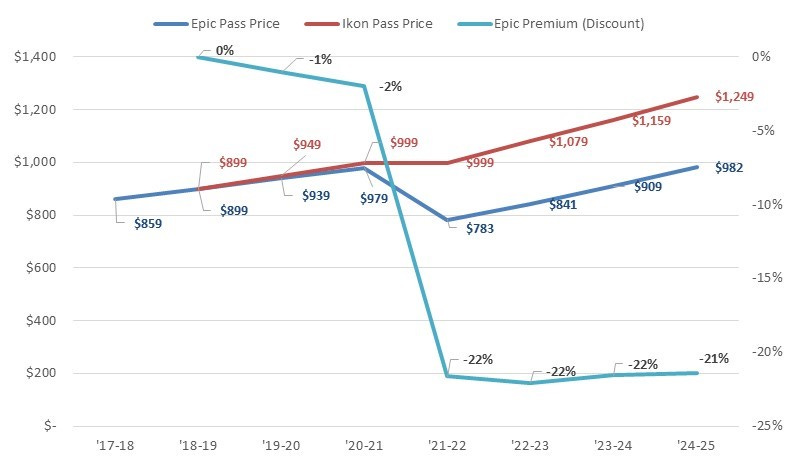

Since the price reset, Vail has papered over decelerating unit sales and adverse mix (more regional skiers and guests opting for lower priced pass options) with ~8% annual price increases. In turn, the company has been able to grind out a 7% CAGR in total pass sales dollars since 2021/2022. This price-driven pace of growth is disappointing and, crucially, unsustainable: even the most zealous, price-agnostic skiers will eventually balk.

Pushing additional guest volume is difficult given already strained lift lines, ski village traffic, and a lack of new entrants into the sport (skiing visits have been flat for nearly 15 years). Ancillary services (dining, ski school) are a function of guest attendance, and the company’s other businesses (lodging) are far too small to move the needle and mainly exist to sell passes.

What is Vail to do to achieve a more durable, less antagonistic growth model?

Raise the price of the Unlimited Epic Pass: $982 for all-you-can-ski at 65 skiing areas is an incredible deal- one that is far too favorable to consumers. Vail ought to at least match the comparable Alterra Mountain Company-owned Ikon Pass ($1,249) and consider raising the price even further (at least one group is likely to pay the higher amount- locals who happily shell out for both passes). The company is more than equipped with the requisite customer data & analytical tools to determine the proper amount/pricing cadence/elasticity, as well as the marketing resources to position the new offering to customers.

Introduce new pass pricing tiers: Following the increase in the Unlimited Pass, Vail now has room to offer additional options to better capture the consumer surplus within each guest cohort. For example, the Epic Day Pass could be expanded (additional days, more add-on discount options, incentivizing attendance during less busy periods, etc.) and more effectively promoted to those who may now be priced out of the Unlimited Pass.

These new tiers also provide optical cover and a credible reason (excuse) to hike the Unlimited’s price: customers, rather than reeling at an aggressive price increase, instead see a menu of diverse options that may be more appropriate to their specific preferences. More cynically, the new choices at least obfuscate the Unlimited’s higher price tag.

There is a risk of cannibalization and lower per caps in certain cohorts as customers who were “overpaying” for the Unlimited Pass are now able to trade down to a more limited option. That said, once again, Vail undoubtedly has the tools and creativity to create new value-capturing products.

Of course, the above is predicated on the extremely arrogant assumption that Vail’s marketing and pricing wonks have not already tried countless pass and ticket iterations. However, two open questions that may influence the current sclerotic model:

The Unlimited Pass has been used with success for over a decade and a half. Overhauling this structure might inflame internal politics and necessitate painful cultural change. Maintaining the status quo and continuing to squeeze out incremental price increases might be preferable to incumbent management whose own time horizon is far shorter than Vail’s terminal value.

Epic has lagged Ikon’s pricing ever since the latter’s pass was introduced for the 2018/2019 season (1.5% vs 5.5% CAGR, though the two have been raising rates at the same pace since the 2021/2022 price cut). Given Vail’s desire to own, operate, and homogenize properties under the “Vail” brand (for context, Vail owns 42 of 65 skiing areas that accept Epic, contrast with Alterra only owning 19 of 71 Ikon mountains)**, is this underpricing an intentional tactic to attract and push guests into other Vail revenue sources (both on an off-mountain)?

A sufficient outside force could override the first and at least demand clarity around the second.

So, with the above in mind and, candidly, as a bit of an experiment, ChatGPT- after being fed a dozen real activist letters, a recent WSJ article, and subject to much cajoling and significant manual edits- produced the following mock-activist letter:

*This includes the flagship Unlimited Epic Pass as well as other paid in advance, non-refundable options such as the Day Pass, Local, Military, and mountain-specific products.

** Stuart Winchester writes a phenomenal business-oriented blog and maintains a very comprehensive database of mountains, passes, pricing, etc.

January, 27th, 2025

Vail Resorts, Inc.

390 Interlocken Crescent, Suite 1000

Broomfield, CO 80021

Attention: Board of Directors

Re: Addressing Operational Challenges and Restoring Stakeholder Confidence

Dear Members of the Board,

As engaged stakeholders in Vail Resorts, Inc. (“Vail” or the “Company”), Armchair Critic Capital, LP (together with its affiliates, “we” or “us”) write to express our deep concerns regarding the recent operational missteps and their impact on the Company’s reputation, financial performance, and future growth prospects. While Vail has long been an industry leader in transforming skiing through the innovative Epic Pass, it has become clear that significant strategic and operational adjustments are required to sustain this leadership position and regain shareholder confidence.

The Epic Pass, which revolutionized the ski industry, continues to deliver unparalleled value to customers. With unlimited access to 42 world-class resorts for a remarkable flat rate, the pass provides extraordinary value that has made premier skiing experiences accessible to more people than ever before. Many passholders recognize this as an unbeatable opportunity- so much so that they eagerly return season after season. However, the pricing structure has created a dynamic where- although customers are benefiting from this immense value- Vail faces increasing pressure to meet the operational demands of such high volume. Balancing this equation is essential to sustaining the exceptional experience guests have come to expect, while ensuring the Company can continue to thrive in a competitive landscape.

For the first time since its introduction in 2008, the Epic Pass has experienced a year-over-year decline in unit sales. This decline signals growing dissatisfaction among customers, exacerbated by operational challenges at key resorts like Park City, Utah, and Whistler Blackcomb. These issues, including long lift lines, frequent closures, and the recent 12-day ski-patrol strike, have eroded both the company’s reputation and guest experience- the latter a core tenet of Vail’s value proposition.

Compounding these challenges is the increasing competition from rival multi-resort passes, as well as the sheer amount of alternative experiential and entertainment options available to consumers today- underscoring the need for Vail to adapt to changing guest preferences.

Despite these concerning trends, the Company continues to rely heavily on annual price increases with little innovation in the Epic Pass structure. This strategy, while effective in the past, is no longer sustainable. Vail must offer products tailored to its various customer cohorts while addressing the root causes of guest dissatisfaction and operational inefficiencies.

To restore Vail’s leadership position and drive long-term shareholder value, we urge the Board and management to take the following actions:

Introduce a Strategic Pricing Overhaul: Set the unlimited Epic Pass at a higher price point to reflect its true value while introducing new pass tiers to better cater to different customer segments. These new tiers would allow Vail to unlock latent topline opportunities and optimize the balance of value provided and received with each guest type. Importantly, this would retain the successful pass model that has afforded Vail stability and certainty of investment planning in an otherwise highly seasonal and weather-dependent industry.

Enhance the Guest Experience: Prioritize prudent investment in on-mountain operations, including staffing, infrastructure upgrades, and snowmaking capabilities, to minimize disruptions and improve overall resort quality.

Address Overcrowding and Competition: Manage crowding at marquee resorts through improved pricing and predictive technology investments while providing the differentiated experience that sets Vail apart from competitors.

Strengthen Employee Relations: Proactively address employee concerns, such as those raised during the Park City ski-patrol strike, to attract and retain top talent. A satisfied and well-compensated workforce is critical to delivering exceptional guest experiences.

Rebuild Trust with Stakeholders: Improve communication with customers and shareholders alike, offering transparency regarding challenges and the steps being taken to address them.

Vail’s potential remains immense, but realizing this potential will require immediate action and a renewed commitment to the values that have defined its success. We look forward to your response and stand ready to engage in further dialogue to ensure the Company is positioned for sustained growth and leadership in the industry.

Sincerely,

Armchair Critic Capital, LP

I have no idea how your work doesn't have hundreds of likes. Please keep up these posts, they're great! Just read through about 5 of them.