Reading Tea Leaves: Two Budding Buyout Targets

Loosely structured notes on two (potential) emerging special situations

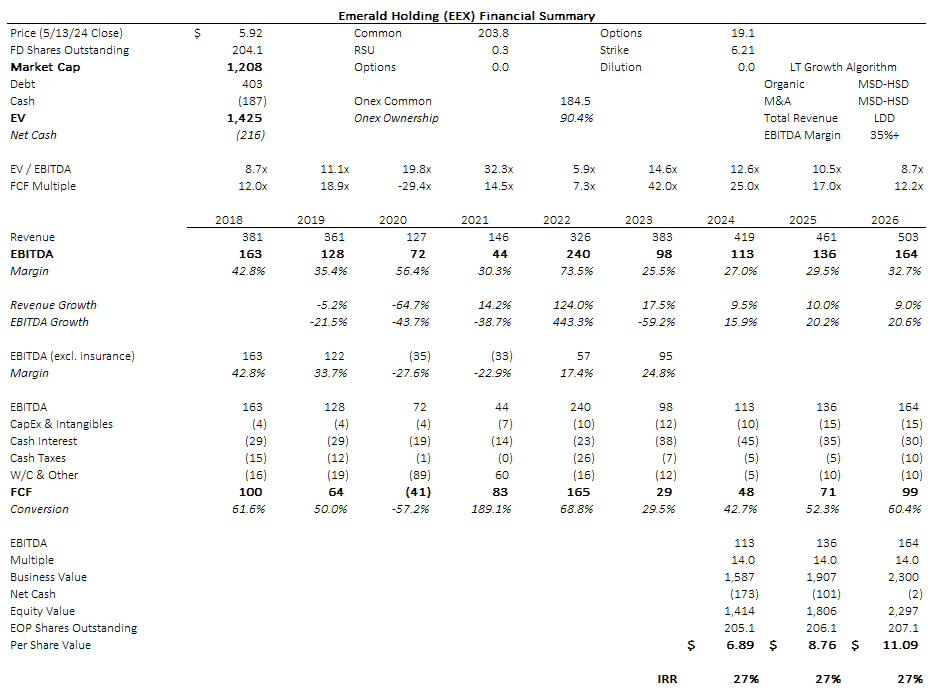

Emerald Holding (EEX)

Trade show organizer & operator, business shutdown during COVID, accepted rescue financing in 2020 from former PE owner, Onex, in the form of 7% preferreds.

April 18th, EEX announces mandatory conversion of all preferreds to common on May 2nd. Will have a single class of stock + no more accrual on preferreds.

So what?

Float: Historically thinly traded given Onex ownership & ~70% of equity value tied up in the preferrds. While Onex will still has a 90% stake in the as-converted stock, the conversion this could pave the way for a secondary/more liquidity or outright sale.

Buyout: credible sale/buyout rumors in the past (Reuters). U.K. comp Hyve Group (HYVE-GB) was taken private for 16x forward EBITDA in 2023

EEX currently trades at 12.5x guided 2024 EBITDA at (depressed) margins- 800 bps lower than management’s targeted 35% in “the coming years”

Perhaps attractive to a buyer that sees this same recovery path. A 14x 2024 EBITDA offer would be about a $7 share price, nearly a 30% IRR

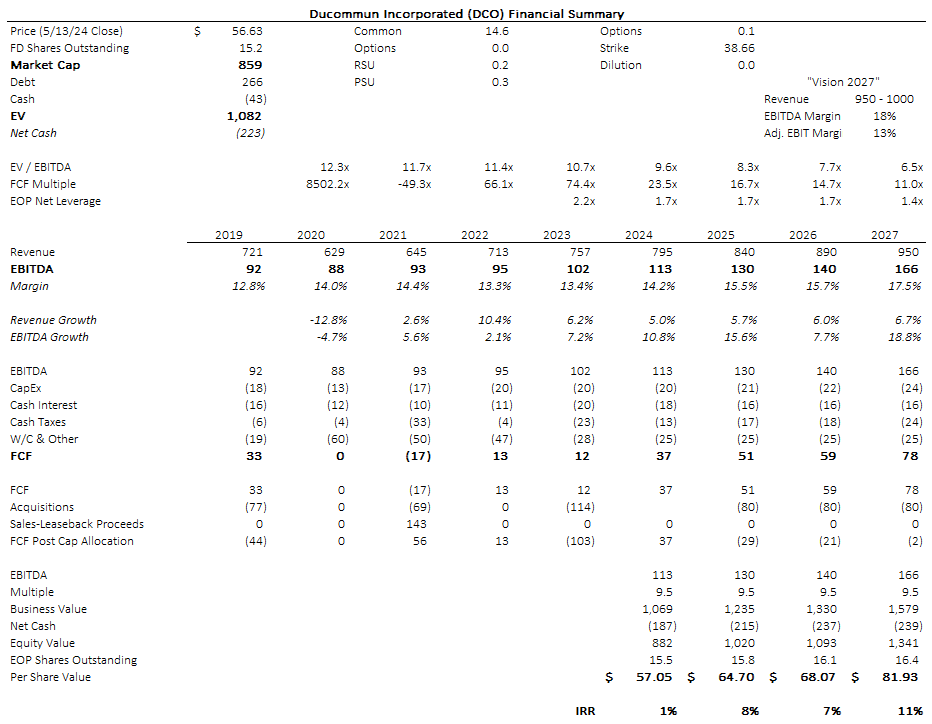

Ducommun (DCO)

Aerospace supplier of electronic & structural subsystems to defense primes & commercial aircraft OEMs (e.g., supplies the spoiler flaps on 737’s used to slow the plane on touchdown).

April 16th: DCO rejects a $60 / share offer (10x ’24 EBITDA) from 9% PE owner, Albion River

Two paths from here:

(1) No deal

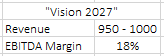

In rejecting the offer, DCO management reaffirmed its commitment to “Vision 2027” (first laid out in December 2022), implying 3.5% organic revenue CAGR with $75M of targeted M&A, LDD EBITDA CAGR with 400 bps margin expansion:

Between commercial aerospace (read: Boeing & Spirit issues) backlog recovery, continued shift to defense, cost savings & sale lease back plans, management’s credibility*- 2027 targets may be realistic.

If 2027 targets are achievable, coupled with the demonstrated PE & possible strategic interest, this may be a business underpriced at the current 9.5x EBITDA multiple.

(2) Deal: Sale of DCO

May 10th: Friday evening 8-K change in control revision: CEO/Chair (Steve Oswald) severance multiple increased from 2.0x to 2.5x base & bonus >> extra $1M cash

Since Albion’s offer, management’s 2024 equity awards have now been granted. Assuming Oswald’s 2024 comp package is similar to 2023’s, in a sale, he stands to make >> an additional $6M

Note: Oswald also owns >2% of the company

With equity awards / change in control amendments in place, DCO management is now considerably more (to the tune of ~$7M for Oswald) incentivized to engage with Albion or any other bidders

*CEO & CFO joined 2017 from UTC, strong track record of growing the company, while deleveraging, + increasing profitability

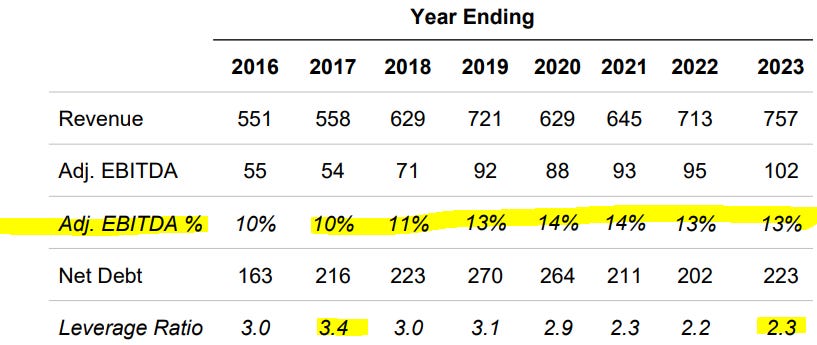

EBITDA Margins: 9.7% in 2017 >> 12.8% in 2019 pre-COVID >> flat during 2020/2021 >> 13.4% in 2023 with Spirit AeroSystems & Boeing 737/787 issues: