Thesis

Progeny, Inc. (PGNY) is a former growth darling that has sold off on topline deceleration, poor Street expectations management, and the loss of a large, but far from crucial customer. However- despite the ugly chart and the investment community’s palpable frustrations- these issues are fleeting, non-structural, and likely to be resolved in the short to medium-term.

Looking beyond these immediate pressures, PGNY remains an asset-light, easily scalable, best-in-class operator in an industry with enormous white space and powerful secular tailwinds. The bet becomes especially asymmetric seeing as this reasonably good business trades at 5.5x 2025 consensus EBITDA with 80%+ FCF conversion, almost 20% of its market cap in net cash, credible path to grow at high teens-plus rates, while expanding margins and continuing to return capital to shareholders.

Assuming a low single digit (LSD) 2025 as PGNY laps the customer loss and utilization rates reset to a (still below historical average) level, growth then reaccelerates to the mid/high teens in 2026 and 2027 as the company captures a expanding TAM. New product offerings and operating leverage efficiencies boost margins by nearly 200 bps, resulting in $300M of EBITDA and $2.75 of FCF per share in 2027. A ~constant 6x EBITDA multiple nets a $26 share price and 20%+ 3-year IRR. With a modest re-rate to 8x, the IRR jumps to the low 30%s- all with cash piling up on the balance sheet and runway for continued low double digit (LDD) topline growth.

Background

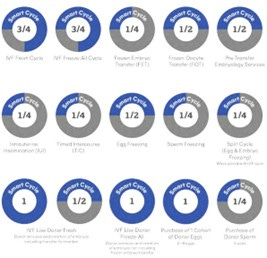

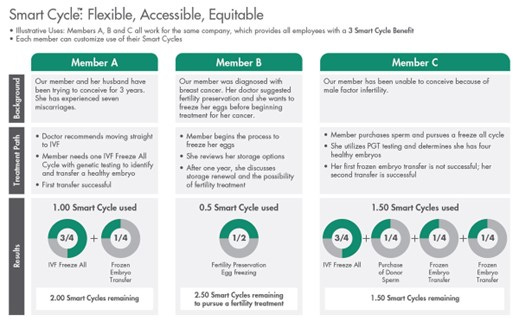

Progeny is a fertility benefits manager (FBM) that serves as a customer service layer between employers and third-party healthcare providers. Enterprises purchase “Smart Cycle” bundles for their employees (“members”). These cycles are credits for various assistive reproductive technology (ART) fertility treatments, most notably- in vitro fertilization (IVF). Members can redeem these cycles for services at any of PGNY’s 650+ partner provider locations across the U.S.

Once a cycle is spent, Progyny pays the provider (based on a pre-negotiated cycle-to-fee-for-service conversion rate), bills the employer, and takes a ~20% cut of the total fee (revenue is reported gross of payments to providers- so, gross margin better approximates net revenue). The company also charges a placeholder “per employee per month” (PEPM) fee (1% of sales, presumably very high margin).

Along with the core FBM, the company also has a captive pharmacy benefits solution in Progyny RX, which is utilized by over 90% of clients.

The company argues its model benefits all parties involved:

Employees (Members): On average, uninsured patients can expect to pay $50,000 for a full IVF treatment, whereas Progyny members’ out of pocket cost is typically around $1,500 (slide 19). Progyny also points to (as corroborated by industry peers & independent consultants) quantifiably better outcomes for its members versus both the national average and non-members that use the same partner providers.

Much of these positive results can be ascribed to the company’s unique Smart Cycle structure, which incentivizes selecting the most medically appropriate treatment method. In the traditional fixed dollar-cap modality (e.g., a $20,000 benefit fungible across any fertility treatment) offered by competitors, patients may receive or select sub-optimal treatment due to overriding financial considerations (e.g., the laundry list of items and services that are required can lead to mis-budgeting and the inability to complete treatment).

Finally, IVF is a complicated, difficult, and all-consuming process. In addition to greatly streamlining provider services, scheduling, medications, payment, etc., PGNY provides members with a dedicated Patient Care Advocate (PCA) who can assist with anything from logistical to clinical to emotional guidance.

Employers: Offering specialized fertility benefits can be an effective and differentiated means of attracting and retaining talent- something many of Progyny’s Big Tech clients obviously value quite highly. The company also claims its superior clinical outcomes (e.g., lowered risk of a multiple pregnancy [twins, triplets] avoids the non-linear increase in hospital expenses per coincident birth) can save employers 30% versus general health insurance plans.

Providers: Although Progyny usually negotiates a lower fee rate than a standard insurer (industry experts indicate this discount is around 10 to 15%), access to the FBM’s large, motivated pool of patients means providers can more compensate for the lower price with added volume. Progyny also manages the billing, scheduling, and medications (through Progyny RX)- reducing providers’ administrative burden.

Busted Growth Name: What Happened?

After multiple years of mid-double digits growth and seven straight quarters of beat and raise, starting in early 2024 with 2023 earnings, Progyny’s growth story began unraveling. The company repeatedly missed and guided down for a variety of disparate items including unfavorable product mix shift, fallout from the Alabama Supreme Court decision functionally banning IVF, and utilization and ART cycle trends that bucked historical trends.

Adding to the woes, in September, Progyny’s largest client, Amazon (13% of sales), notified it was not renewing its contract for the 2025 calendar year, and instead choosing competitor, Maven.

As a result, PGNY’s FY 2024 guided topline growth has collapsed from 20% to 5% and the reader can extrapolate investor sentiment from a quick look at the chart.

However, these are temporary issues that are fixable, will correct in time, and that the company is already addressing.

Guidance: Over Promising, Under Delivering

2023 saw record utilization, ART cycles per user, and revenue per ART cycle. Management, likely emboldened by this recent outperformance, assumed these unprecedented metrics would continue and guided 2024 accordingly. Even when providing an updated outlook during Q2 earnings (August), the guide optimistically implied a return to historical patterns- despite conflicting usage evidence at the time and management’s admitted uncertainty as to why 2024’s seasonality differed from past years’.

After several disappointing prints- with the stock punished in turn- as of Q3 (November) management finally seems to be giving more conservative projections that bake in further KPI deterioration (again, contrary to historical norms). Though it remains to be seen if this final 2024 guide proves cautious enough, the shift in tone and transparency regarding revenue visibility (slides 60 - 64) is notable.

CFO Mark Livingston, Q3 earnings:

“I think we certainly learned lessons throughout 2024. Really, they're about the variability that's happening within the business itself. What we're doing here this quarter is incorporating a greater emphasis on the variability that we're seeing and a little bit less reliance on the most current data point to drive where we think those ranges should be set. That's the philosophy that we're going with right now.”

Beyond the current quarter, management (and IR) will hopefully internalize these painful lessons and better anchor investor expectations by setting very achievable guidance for 2025. Though fundamentals are paramount over the long term, playing the public company “game” by engendering credibility and goodwill with the Street (along with a beat and raise every now and then) undoubtedly has a material effect on multiples.

As one exasperated shareholder explained during the August Investor Day:

“My recommendation… in the short term, start guidance using the low end of the historical range as the basis. Say: ‘in the near term, we don’t have much visibility beyond two months.’ Let the upside take care of itself. That way, you don’t have to waste time answering (investor) questions. These days, the Street is getting more and more short-term oriented.

…Stream together a series of upside quarters to help rebuild credibility among shareholders and (PGNY’s) multiple will expand…. (Many) companies, start with conservative guidance, surprise on the upside, and their stocks command a premium to their peers.”

Loss of a Key Customer

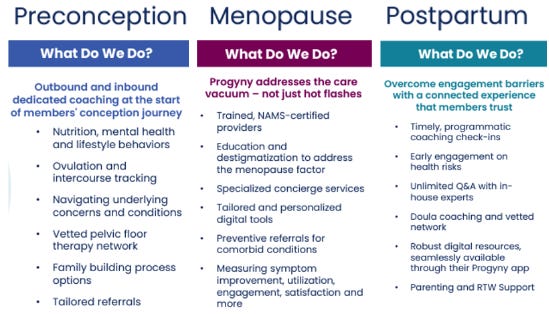

There is no official word on why Amazon dropped Progyny (other than boilerplate stating there were no major issues between the two). However, Maven initially partnered with Amazon in summer 2023 (alongside the existing Amazon-Progyny relationship) and industry insiders speculate that the e-commerce giant was looking to consolidate to single vendor for women’s health benefits. Maven’s holistic suite of women’s health offerings- fertility, pregnancy, postpartum, menopause, etc.- won out over Progyny’s one-trick fertility solution.

Although Progyny’s long discussed widening its offerings beyond core fertility, 2025 will be the first year its menopause and postpartum services are live at scale. Employers representing over 20% of the company’s covered lives have added at least one of these ancillary products (20% of existing clients upgrading and 40% of new clients electing these add-ons).

These are ostensibly encouraging adoption numbers, but PGNY is clear that it does not expect these offerings to drive “meaningful revenue contribution” in 2025. Regardless, they are an important step towards Progyny becoming a more diversified, engrained benefit manager that can better compete (or play defense) on core fertility RFP mandates, cross and upsell current clients, and expand its addressable market into the broader world of women’s health.

Growth Outlook

Even prior to the Amazon loss, Progyny’s repeated misses in 2024 called into question the company’s high teens+ growth narrative. However, the lack of a singular problematic KPI weakening across quarters, coupled with management’s inability to discern any underlying reason for the ahistorical variability and seasonality (particularly when any sort of explanation / certainty would have been welcome by investors), signals that this is most likely short term volatility and that fertility’s secular momentum has not diminished.

Fertility Demand: As women delay motherhood until later in life, their natural ability to become pregnant rapidly decreases. Progyny also cites CDC data suggesting as many as 20% of women (with no prior births) struggle with fertility. When combined with other factors, such as a growing cohort identifying as LGBTQ (and plans now covering this group), it is perhaps unsurprising that ART cycles (99% of which are IVF) have more than doubled over the past ~decade- with a 10.5% CAGR from 2012 to the latest data point in 2021.

Considering these tailwinds show no signs of slowing and that the U.S. lags other developed countries in IVF penetration (where IVF is more affordable and/or covered by insurance), it seems reasonable to expect growth to continue.

Expanding the TAM: Progyny quantifies its current market at around 106M lives, consisting mostly of self-funded employers with more than 1,000 employees (this figure roughly maps onto estimates of self-insured covered lives at larger employers). At 6.7M covered lives, the company’s penetration rate is around 6%.

Progyny believes that by moving down market to small & medium businesses* (SMB) with 250 – 1,000 employees it can add another 50M lives to its TAM (~155M total). There are promising anecdotes that the company’s Smart Cycle model resonates with cost conscious SMBs (for reasons discussed prior- namely, better outcomes that avoid onerous hospital bills), but the 2024 selling season for the 2025 calendar year was a “very similar (customer) makeup” to past years’ (read: the clients were the usual suspect large employers).

Currently, the major health plans (e.g., UnitedHealth’s Optum) tend to dominate the SMB fertility space. However, fertility is a highly specialized sub-discipline and a de minimis revenue item for these large plans. If PGNY can demonstrate cost savings relative to traditional providers and scale its sales strategy- perhaps selling through plan consultants who are familiar with the Progyny offering- then it appears to stand a good chance against the less economically interested, lower quality-product majors.

So, the SMB-led TAM expansion strategy seems feasible, but so far there is little hard evidence of traction, and its success requires overcoming several non-trivial obstacles. Given this uncertainty and the intentionally ambiguous time frame on realizing a 155M+ covered lives market (implicitly around 2028- coinciding with the company’s other long-term targets), the below illustrates how PGNY can grow its members at a high single digit (HSD) rate even if the TAM is cut by 30% (15M lives). The penetration rate is expected to modestly rise with the roll out of new products, increasing interest in and demand for fertility, and taking share from struggling competitors.

Putting this all together for a sense of “normalized” growth:

The broader fertility market compounds at a HSD rate.

PGNY’s TAM (which includes new products and higher penetration rate) also expands at a HSD pace.

Modest pricing in line with inflation adds another one to two percent.

Without resorting to any heroic assumptions, Progyny can reasonably grow its topline at a high-teens+ rate in the medium term.

*SMB is the main target market, but Progyny also plans to (further) expand into government, school, and global populations

Valuation

LSD revenue growth in 2025 as PGNY digests the Amazon loss and the larger proportion of new members relative to existing skews female utilization lower. Lapping this easy comp, topline reaccelerates to the mid-teens+ in 2026 and beyond as members are added through new wins (which further depresses utilization), upselling additional Smart Cycles as well as ancillary products, and ART cycles per user returning to the long-term historical norm.

Core fertility gross margins stabilize at just under 22% as Progyny realizes some scale advantages and the move down market brings slightly higher margin business (clients with less than 10,000 lives have gross margins 175 bps wider than larger employers). Non-fertility products (menopause, postpartum, etc.) with implied 50%+ contribution margins (unlike the bundled fertility Smart Cycles, these products have a higher take case rate model) reach 7% of sales, pushing consolidated gross margins to 24%.

To drive utilization and penetrate new markets (SMB, global, etc.) sales and marketing expenditures grow as a percentage of revenue. However, these are more than offset by gross margin expansion and savings through general & administrative operating leverage. EBITDA margins rise to 18%+, with room to expand in outer years.

Aside from cash taxes and working capital needs as a growing member base uses Progyny’s services (Progyny pays providers prior to billing clients), the drop through from EBITDA to FCF is quite good- with the company enjoying a 75%+ conversion rate.

With continued repurchases and the company’s planned moderation in stock-comp and, Progyny could produce $2.75 per share in FCF (sub 10x). A 6x multiple on nearly $300M of 2027 EBITDA nets $26 share price- all with over $300M of balance sheet cash and no debt.

However, given Progyny’s position, expected trajectory, and financial profile, a re-rate to 8x EBITDA does not seem particularly egregious: if so, this is a $33 stock with a low 30s% 3-year IRR.

Bottom Line: despite its struggles this past year, PGNY remains well positioned to soon reaccelerate growth by offering a superior product into a market with strong secular tailwinds. Recent public communications gaffes are easily fixable and the frustrating, one-off issues should dissipate over time. At 5.5x 2025 EBITDA, with a cash generative financial profile, management returning capital / interested in driving shareholder value, and expectations (and investor morale) at a nadir, this appears to be an attractive, asymmetric buying opportunity.

Risks

Until Progyny can prove it can hit (or exceed) its guidance without any unforeseen and inexplicable issues, it remains a falling knife (tax loss selling has probably exacerbated this decline over the final weeks of 2024). Longer term, much of the company’s growth prospects rest on its ability to move into different markets and offer new services. Though PGNY is well equipped to capture these new spaces, execution is always difficult. Until there is demonstrated success, a “show me” overhang will likely persist.

Competitive pressures from other FBMs and large health plans should be watched closely. If the Maven loss turns out to be due to a flaw in Progyny’s core fertility product (e.g., bad customer experience, too expensive) and not because of the theorized lack of ancillary offerings, then the entire thesis must be closely re-examined.

Great read, Will. Insiders must have read it as well - two large purchases in the past week by the CEO ($3.0MM) and Executive Chairman ($2.2MM).