KBR, Inc. (KBR)

An interesting potential special situation with compelling fundamental backdrop:

Background

KBR is a contractor that provides a wide array of engineering and technology services to governments and companies globally (from IT/cyber security to prototyping to energy engineering & procurement to medical support).

It operates in two segments: Mission Technology Solutions (MTS, 70% of sales) that primary sells to governments and Sustainable Technology Solutions (STS, the remaining 30%) that caters to corporates & national/international energy (oil) companies.

As KBR derives nearly 60% of its revenues from the U.S. government (presumably mostly federal), the company experienced the same post-election, DOGE-fears related sell-off as the other major contractors (CACI, BAH, LDOS, SAIC, etc.).

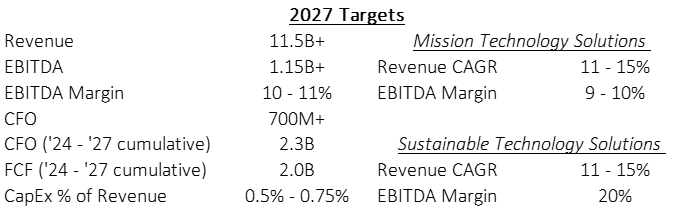

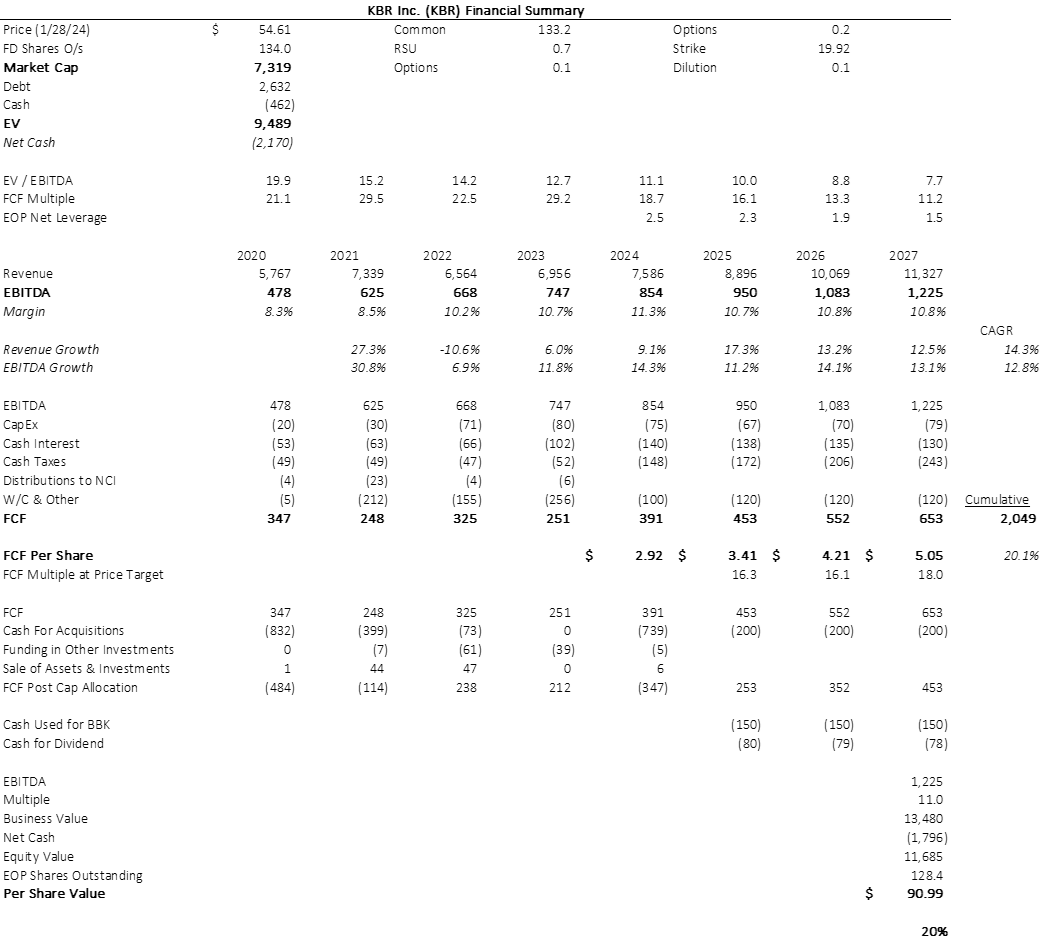

In May 2024, KBR released 2027 financial targets. Assuming these are feasible and baring any rerate, the stock pencils out to a ~15% 3-year IRR.

While a mid-teens return for a reasonably high quality, cash generative business is appealing, the real upside comes in the break up scenario.

Splitting the Business

Although the two segments have similar projected growth rates, STS’s margins are double that of MTS’s while also lacking the (U.S. Government) customer concentration risk (again- particularly salient today).

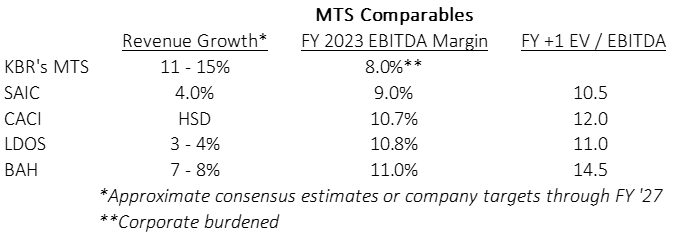

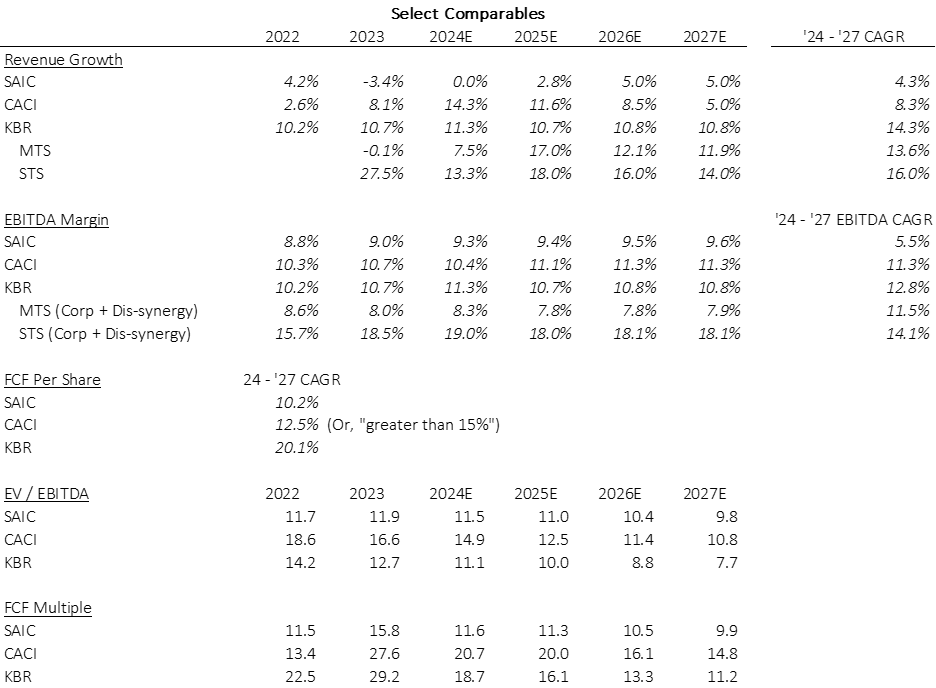

Despite higher anticipated growth and comparable/wider margins than other contractors, KBR- at a just over 10x FY ’25 EBITDA- tends to trade at a 1-2x turn discount to peers (though this has compressed recently as the industry has sold down).

With KBR consolidated’s persistent relative undervaluation, in part from the alleged lack of appropriate comparables to accurately price the STS business, a popular idea has been to split the company in two:

Mission Technology Solutions: standalone MTS would fall into the well-understanding government contractor bucket, likely trading in line with competitors such as SAIC and LDOS- 11x EBITDA.

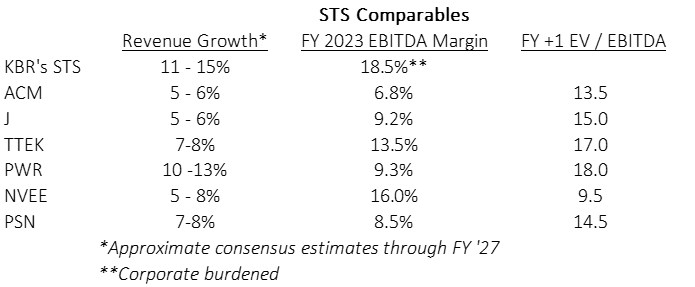

Sustainable Technology Solutions: STS is somewhat unique in that many would-be energy exposed EPC (engineering, procurement, construction) comps (e.g., ACM, J, NVEE, TTEK) have considerably lower forecasted growth rates and EBITDA margins.

Given STS’s financial characteristics, the business’ powerful secular tailwinds in the “energy trilemma” (energy transition- e.g., natural gas, renewables, climate change- e.g., carbon capture), and lack of customer concentration, a 14x EBITDA multiple seems appropriately conservative.

KBR formers suggest overlap between the two segments is minimal:

Former KBR VP of Finance:

“A lot of the jobs, both on the (STS) side and on (MTS) are people jobs. To the extent that people need to show up, there's not a lot of synergy. But, to the extent that there's underlying technology like the asset management or construction expertise, we certainly share openly across the company. There's just not as much synergy as you would think given the two things that they do.”

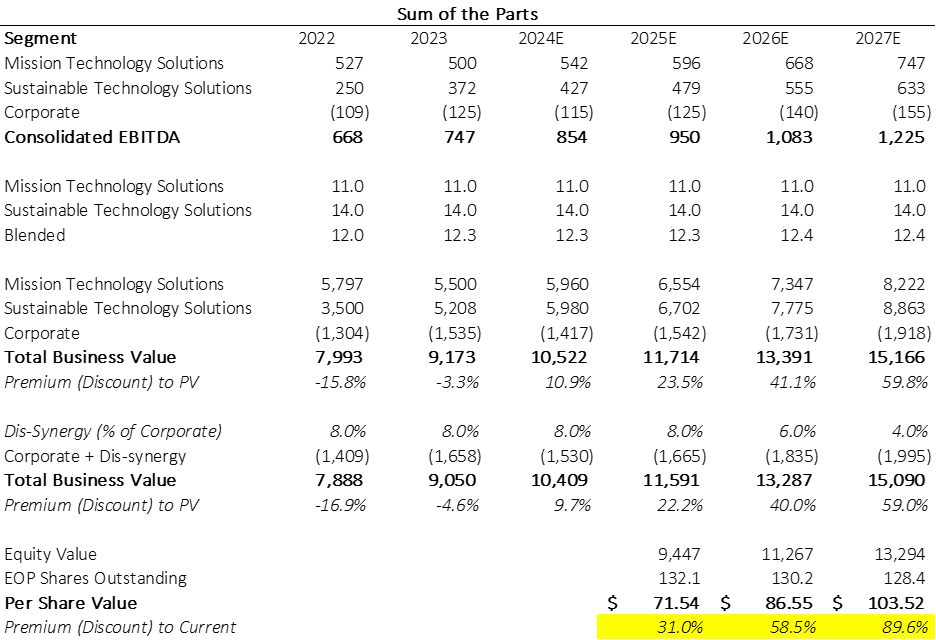

Applying the 11x MTS and 14x STS multiples, along with some dis-synergies that decline over time as the inevitable separation costs fall/efficiencies are found- KBR appears to be trading at a sizable discount to this “fair value.”

Without naming names (IAC), sum of the parts analyses look nice on a spreadsheet, but seldom manifest without a hard catalyst and acquiescent (or coerced) management.

Activist Involvement and Re-segmentation

In mid-December, the WSJ reported that activist investor Irenic Capital had built a stake in KBR and was advocating for a sale or spin of the STS business. Although a newer fund, Irenic found recent success in pushing for the sale of Barnes Group (B) to Apollo in late 2024.

Ken Squire of 13D Monitor offers more background on Irenic, possibility of a proxy contest, and Honeywell (HON) as a would be acquirer of STS.

In early January, KBR re-segmented its two businesses. This realignment involved transferring the “Critical Infrastructure” division to STS- adding about 15% to the segment’s topline. Historically, management was reticent to separate STS as they were concerned it lacked scale:

KBR CEO, Stuart Bradie (1/8/25)

“There are many considerations around looking at values of a breakup opportunity. They include healthy end markets. Scale is a big factor… and the additional cost and distraction as a consequence of any strategic actions. There are issues around the fact that, as a smaller subscale company, STS would have challenges around bonding and things for large projects…

We spoke about making the segments more self-sufficient. You shouldn't read anything into that other than it's exactly the right thing to do. They're both scaling and it makes far more sense from a cost benefit (perspective) and actionable support basis to have those capabilities sit inside the segment.”However, in looking at what management did, not what they said:

1. Made a conscious decision to bolster STS suggesting management is at least open to a split. Considering the newly organized STS business likely generated over $400M of EBITDA in 2024 (pre-corporate expenses) on $2B of revenue, it would certainly be viable independent small-mid cap public company or a digestible size to a larger strategic.

2. Deliberately created duplicate support systems (e.g., reporting) to make each segment more “self-sufficient” and progressively functionally disparate companies. Sell or spinning off an increasingly self-contained STS has never been easier.

Today, there is a management team that seems amenable to a breakup and a credible activist to catalyze the split. Perhaps the sum of the parts could be realized after all.

What Now?

KBR remains a single company: if it can achieve its 2027 targets, including modest repurchases and assuming some M&A spend, the business can likely produce $5 of FCF per share (11x) and end the year well below 2x net levered. On a flat 10x EBITDA multiple, it is an $80 stock for a mid-teens IRR. A rerate to 11x (in line with government contractor comps) bumps the IRR to 20%.

KBR separates MTS and STS: understanding the sum of the parts math, segmentation actions, and activist- this scenario does not seem unreasonable.

Determining what exactly might happen in any split (a sale? A spin? To whom? For how much? For what consideration? Etc.) is performative speculation at best, but one outcome could be:

KBR spins off STS in late 2025 (to begin trading then or in early 2026). KBR shareholders retain equity in the spin.

RemainCo MTS ($650M+ 2026 segment EBITDA)- now more easily comparable to the other contractors- rerates to 11x, while STS ($550M 2026 segment EBITDA) with its attractive financial profile trades at 14x.

With dis-synergies, the combined-soon-to-be-separated business is worth ~$13.3B.

With repurchases and cash build, the aggregate share value is $85- a nearly 60% premium to the current price. If this value can be realized by mid-2026, including dividends, it would be a healthy 40% IRR.

So, if/how/when any split or transformative corporate action will occur is impossible to know. However, there are strong signs that something will happen.

Failing that, if one is comfortable with the long-term targets and nearer term DOGE risk (either perceived or real), then KBR at 10x EBITDA could be a promising entry point.