James Hardie (JHX): LONG

Thesis

James Hardie Industries (JHX) is an Australian-listed producer of fiber cement siding that has agreed to acquire composite decking manufacturer The AZEK Company (AZEK) in a $8.75B cash and stock deal. For various reasons including the steep 21x EBITDA acquisition price, shifting of the primary exchange from the Australian Stock Exchange (ASX) to the NYSE, and that the entire transaction is not subject to a JHX shareholder vote, James Hardie owners- particularly Australian Superannuation (retirement) funds- are understandably incensed. These (and other) investors made their displeasure known by selling stock down ~25% following the deal announcement.

Fortunately, a prospective buyer today does not have the burden of re-underwriting the new JHX- as do these “forced sellers”- and instead could pay 13.5x pro-forma NTM EBITDA for a 75% repair & remodel (R&R) business that, normalized, should grow topline high-single (HSD) to low-double (LDD) digits, with low 30s% EBITDA margins, and generate enough cash to repurchase a low to mid-single digit (LSD - MSD) percentage of its shares outstanding annually- all combining for a mid to high teens FCF per share CAGR over the next several years.

Haircutting management’s ambitious synergy targets, at a constant multiple, by FY 2028 (ending 3/31) the JHX|AZEK merged company could be worth ~$44 a share for a low 20%s IRR. Given the high 2-handle net leverage level, if the company proves it can execute on both its organic and synergy goals (perhaps aided by a healthier R&R and housing backdrop), a single EBITDA turn re-rate adds another $3 to $4 per share (8% to 10% the target price).

Recommendation

However, this is a transformative, cross border transaction that adds 70% to JHX’s enterprise value (and two turns of debt) while expanding into an adjacent- though decidedly separate- industry. The deal logic is predicated on realizing considerable “commercial” (i.e., revenue) synergies. Although the full synergies are not required for the stock to “work”, large integrations are seldom as smooth as the accompanying glossy PowerPoint might suggest.

So, until the company can demonstrate progress in achieving these synergies, only a small, starter position is recommended. If these efficiencies begin to appear in the form of higher margins, accelerated revenue growth that is attributed to cross-selling initiatives, etc., then the position should be increased. Conversely, if JHX begins missing guidance- citing integration issues- then it is best to reevaluate the position while also severely handicapping the assumed synergies. Alternatively, if management’s credibility is truly impaired- simply exit altogether.

Background

James Hardie is the leading manufacturer of fiber cement siding. Despite having Australian origins, approximately 75% of sales and EBITDA are generated in North America, the company reports in USD, and senior management (including the CEO & CFO) is largely American. With an estimated 90% share of the U.S. fiber cement market, “Hardie board” has become the generic term for the siding product- much like Kleenex and tissue paper. While the company benefits from a stronger single-family home (SFH, ~85% of sales) building environment, two thirds of sales are R&R related- so, both an aging housing stock and higher existing home sales are tailwinds as (new) occupants are more likely to renovate.

Fiber cement (which is dominated by JHX) has 20% to 25% share of the total siding market. The product’s advantages in water/fire/pest resistance, lower maintenance, & aesthetics is balanced by a notable install cost premium to wood or vinyl options (that premium for vinyl can be anywhere from 50% to 200% - regional/job dependent, while wood’s varies greatly based on the price of lumber).

AZEK produces PVC-based composite outdoor decking and railing products, primarily under the TimberTech brand. Like JHX, 80% of sales are R&R for SFH and composite is generally superior to traditional wood decks (lower maintenance, etc.), with the trade off being a higher upfront cost. AZEK, which historically targeted the premium end of the market, has roughly a 6% share of the total decking and railing space- just behind composite peer Trex (TREX) at 12%. Though wood still represents ~75% of the total linear feet of decking material sold, AZEK notes that composite has added ~100 bps of share a year for the past half decade.

From the JHX side, the merger adds exposure to what was already Hardie’s core market: U.S. single family home repair and remodel.

The tie up has received regulatory approval and is expected to close in the second half of calendar year 2025, subject to an AZEK shareholder vote (which, if the tight deal spread is any indicator, should be an overwhelming “yes”).

Standalone Normalized Growth and Margins

James Hardie

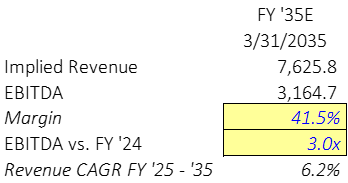

During its investor day in June 2024, James Hardie released the following targets:

As a very crude sanity check, from FY ‘19 through FY ‘25 (COVID-driven remodeling demand has since dissipated), JHX has effectively achieved its HSD CAGR target on its stated algorithm of MSD volume + MSD pricing growth*.

Using James Hardie’s own average figure of 2,600 sqft of siding per home, the company’s products have been applied to well over 1M homes per year for the past half decade. Even if siding volumes were to decelerate to a 2.5% annual growth rate, with a constant square footage per home, JHX would still hit its 25M home target by 2035. Assuming 90% of these homes are single family, JHX products would be present on the 22.5M units- equivalent to ~27% of the existing SFH stock of 83M units. If SFH stock increases by 1M units per year (just over a 1% growth rate)**, JHX’s share drops to 24%- in line with its current market share of 20% to 22%.

This is all to say James Hardie’s topline targets and seem reasonable enough.

The company expanded North American segment EBITDA margins from the high 20% range in FY ’19 to 36.5% in FY ’24 (with a peak of 38.3% in FY ’22 on the COVID-related surge in housing remodeling activity). Facing HSD raw material inflation and tepid demand, management is still guiding to 35% margins- flat with FY ’25- on the back of various (and vague) efficiency measures.

A 500 bps margin improvement to the low 40s% is no doubt ambitious, but JHX has clearly demonstrated cost discipline in the past, has sufficient latent production capacity that should provide operating leverage-based margin expansion once volumes recover (and commodity input costs moderate), and is leaning into new, higher margin products such as its pre-painted ColorPlus offerings.

Tripling North American EBITDA dollars relative to FY ’24, at 41.5% margin (+500 bps vs FY ’24), implies a ~6% revenue CAGR from FY ’25 to FY ’35- again, within the company’s topline growth expectations and assuming a slowdown in the out years as the business further matures.

*The “market” and “outperformance” components are more difficult to isolate. Harvard’s Joint Center for Housing Studies publishes a popular R&R index, the Leading Indicator of Remodeling Activity (LIRA). Over the past seven years, JHX’s North American segment has outperformed the index by just over 1% on an annualized basis- not quite the targeted 4%. However, (A) this is a broad gauge that is certainly not specific to siding markets and (B) JHX’s absolute performance relative to its double-digit target is far more important for informing its normalized growth rate (with the caveat that not too much of this growth comes from unsustainable pricing).

**Housing shortage estimates vary, but most sources indicate that 1.5M to 2M new homes will need to be built annually for the next several years to close the demand gap. SFH have comprised ~70% of starts for the past eight years (& 65% of the existing stock). So, 1M new SFH units at 70% implies 1.4M total homes built per year- in line with what is needed. How much actually will get built is a separate question.

AZEK

AZEK’s consistently targeted the below:

Through the FY ’19 – ’24 (COVID) cycle, the company grew sales at its stated LDD rate. For both FY ’24 and FY ’25 (ending 9/30), management assumed a “0% growth” R&R market, yet posted 5% sales growth last year in FY ’24 and is guiding to nearly 7% this year- both within the 5% to 7% outperformance range.

Considering only ~25% of decks are composite and penetration has been increasing by 100 bps per year (AZEK believes a 50% composite share is possible in the next 10-15 years), railings and trim have further conversion-to-composite upside, and AZEK’s been expanding its product portfolio to cater to a wider variety of customers (read: lower price points), normalized double digit topline growth appears quite doable.

AZEK printed 26.3% EBITDA margins in FY ’24- not far from its full-year 27.5% margin goal. Added volume (& associated operating leverage) from the R&R market’s return to growth, along with continued expense management (opEx as a percent of sales is tracking to fall ~250 bps from FY ’19 to FY ‘25E) is likely enough to squeeze out the extra 100 bps.

Adjusting for periods of elevated capex, as well as COVID-era inventory builds and the subsequent unwinds, FCF conversion has also landed around the AZEK’s ~LDD % of revenue target.

Before the impact of any synergies, the combined JHX-AZEK should grow at a “normalized” HSD to LDD rate with margins eventually settling around 30%.

Synergies

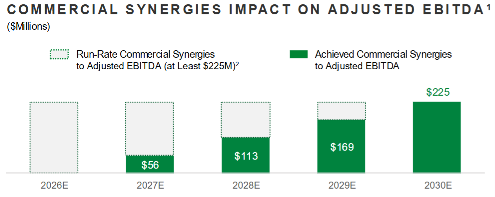

JHX and AZEK claim the merger will bring $125M of cost and $225M of commercial (revenue) run rate synergies. The company will have to spend $350M over the next five years to realize these benefits.

Cost Synergies

Total mature cost synergies are only 13% of the combined FY ’26 (ending 3/31) opEx and 8% of EBITDA (~150 bps of margin). Some of this can, of course, be accomplished through eliminating duplicate administrative and back-end processes, but savings elsewhere are questionable:

Little to No Opportunity to Consolidate Facilities or Procurement: the materials, manufacturing, and (some) R&D processes of each company are different. An AZEK former explains:

“With the merger, I see no raw material synergies at all based on the what the products are made of and the processes used. There's no manufacturing footprint that can be improved. You're not going to take AZEK PVC or Hardie fiber cement and consolidate them into one factory. They're just different products, different manufacturing, different raw material streams. It's pointless to do that, so there's nothing there. Similarly, the manufacturing, technical and management support for those plants need to remain. You can't pull out plant leadership or even secondary leadership because they need to be there to operate the plants… procurement teams will probably have to add together… You still got to buy fiber cement materials and you still got to buy PVC materials. It's not like you can just load all the (materials) onto the same guy who's doing it today.”

Technology Integration: per a former employee, AZEK uses Oracle’s JDE enterprise resource planning (ERP) system, while JHX uses SAP's. ERP migrations are notoriously challenging, and the costs & delays are frequently underestimated by management teams.

As the touted cost synergies are modest relative to the combined company’s total expected EBITDA generation, much of the projected $125M can likely be realized- though perhaps more slowly than advertised given the clearly disparate products and inevitable technology headaches.

Commercial Synergies

The deal’s main draw is $500M of revenue synergies from bundling and cross-selling JHX and AZEK products at a 45% contribution margin, all for a $225M flow through to EBITDA (14% of FY ‘26 EBITDA). Sales synergies are always tenuous and should be viewed with skepticism:

Two step distribution: both James Hardie and AZEK primarily sell to distributors or lumber yards (step 1), which then sell to contractors (step 2). So, while management claims 55% of contractors install both siding and decking (said differently- 45%, or almost half, do not), the success of any cross-selling is dependent on distributors’ ability (e.g., requisite knowledge to sell a new category of goods or simply have the physical space to store additional bulky building materials) and willingness to accept the two products.

Adjacent, but Not Complimentary Products: though siding and decking are exterior, discretionary building products that 55% of homeowners allegedly (footnote, slide 24) install together, this is not a hotdog & bun relationship: they are ultimately unrelated with no real cross benefits. Sure- one might enjoy looking at nice siding while on her deck. Then again, maybe the siding “deficiency” is only noticed and then acted upon after the homeowner has spent time siting on her deck.

Convincing homeowners to install both siding and decking in single project is certainly not impossible, but the purported frequency and (synergistic) upside should be tempered as there is no compelling reason to buy the two simultaneously. Of course, the dual process greatly increases the size, cost, and duration of the remodel.

The commercial synergies are not without merit, though these two structural impediments to easy cross-selling, as well as the obvious execution risk inherent in integrating two independent sales forces, mean there needs to be evidence (e.g., an acceleration in siding or decking sales with high contribution margins) before the synergies can be fully believed.

Other Factors

Change in Control: venturing a bit too far into tea leaves territory, in December, three months prior to the deal announcement, the AZEK board approved an increase to the CEO’s and other senior management’s change of control severance package. Seeing as the company seemed to be executing well enough on its own and the stock traded at a generous multiple, there is a lingering question of why the board felt the need to clearly incentivize a sale.*

This is a minor consideration compared to the validity of the purported synergies, but it introduces a (small) risk of adverse selection for JHX owners.

Relisting and Index Inclusion: following the close of the deal, JHX plans to move its primary listing from the ASX to the NYSE. Management expects the company to eventually be eligible for U.S. index inclusion, while also maintaining its Australian inclusion status. It is no secret that passive flows associated with index membership can be a powerful re-rating catalyst.

*This change of control amendment was adopted concurrent with the AZEK board rejecting an all-stock preliminary offer from JHX, and insisting there be a cash component.

Valuation

JHX’s North American segment grows topline at LSDs in FY ’26, driven almost entirely by pricing. Volumes are nearly flat on a weak SFH outlook, though see some support from a bottoming/recovering R&R market. Performance in the immediate out years, of course, heavily depends on the macro environment at the time. However, rates seem more likely to fall rather than rise, the housing supply/demand mismatch is far from resolved, the current housing stock continues to age, and- largely due to its R&R exposure- JHX demonstrated some resiliency as it grew volumes in FY ’24, despite SFH starts collapsing by ~30%.

Assuming a more benign new SFH market along with continued improvement in R&R, JHX could grow volumes MSD+ with LSD+ pricing for a HSD to ~10% total North America topline. Coupled with a return to MSD growth in its Asia Pacific & European segments, all in JHX revenue growth is HSDs in FY ’27 and FY ’28.

AZEK tracks management’s ~7% guidance for FY ’25 ending 9/30, with some broader R&R-driven acceleration towards the back half and beyond. In FY ’27 and FY ’28, AZEK returns to 10% topline growth on its historic R&R + 5% to 7% outperformance algorithm.

Commercial EBITDA synergies are haircut by 50% and added to revenue at the stated 45% contribution margin. Even with this punitive adjustment, consolidated JHX|AZEK revenues still grow at a ~10% rate in the medium term.

Following the volume, mix, and fixed cost dynamics discussed earlier, James Hardie’s North American EBITDA margins expand to 39% by FY ’28 (200 to 300 bps below management’s aspirational level), pulling JHX’s firm-wide margins to the low 30s% as Asia Pacific’s & Europe’s remain mostly flat.

Operating leverage from normalized (higher) volumes allow AZEK to reach its 27.5% EBITDA margin target.

Cost synergies are discounted by 25% and the expected $350M of synergy realization/transition expenses between FY ’26 to FY ’30 occur evenly over the period ($70M per year).

By FY ’28, total JHX|AZEK EBITDA is north of $2.1B (9.5x) at a low 30s% margin.

JHX capEx continues to decline as a percentage of sales in FY ’26 and FY ’27 as the company exits an investment cycle. The merged company settles around AZEK’s current target level of capEx at 6% to 7% of revenues. Interest expense remains elevated as JHX|AZEK chooses to return cash to shareholders (including a guided $500M repurchase in the 12 months following the deal close) and de-lever via EBITDA growth, rather than pay down debt.

FCF conversion improves alongside EBITDA growth/margins, settling in the mid to high 40s%. FY ’28 could see $900M of FCF, net leverage well below 2x, and, with additional repurchases funded exclusively by internal cash generation, ~$1.50 of FCF per share (17x).

A flat 13.5x multiple on $2.1B of FY ’28 EBITDA is a $44 share price and a low 20s% IRR. A rerate to 15x (a better blend of JHX and AZEK’s standalone, no-synergy multiples) pushes the stock to $50.

Bottom Line: this is an aggressive, questionable deal that reeks of empire building. However, both JHX and AZEK are well run, nicely positioned companies that should enjoy healthy growth, expanding margins, and excellent cash generation over the medium to longer term. The rich (arguably excessive) price paid for AZEK should not dissuade a new investor from viewing JHX as an opportunity to buy a leading building products manufacturer on what may be trough earnings and peak negative sentiment.

Risks

Although JHX and AZEK performed well through the disruptive COVID period, siding and decking remain discretionary, high ticket, nice-to-have items. Unlike a roof or plumbing fixture that must be repaired immediately, if there is a downturn- or even a protracted period of economic weakness- consumers can easily forgo largely cosmetic siding or recreational decking purchases.

At nearly 3x levered, any macro jitters will likely have an outsized effect on the stock and a slowdown may force the company to conserve cash to appease creditors- limiting shareholder cash returns.

Finally, it cannot be overstated how transformative mergers are always fraught with countless operational and integration struggles. The potential for persistent dis-synergies from any number of technical, organizational, cultural, etc. must be monitored closely- especially if management is repeatedly adamant that they will turn the corner “soon.”