Thesis

Grocery Outlet (GO) has come under pressure on fears that weak performance in its newer units indicate cracks in the company’s long-term growth story. These concerns are overstated and have been exacerbated by temporary, yet frustratingly persistent enterprise resource planning (ERP) implementation issues. Already, unit operator health appears to be recovering and ERP disruptions are no longer a drag on margins or gross profit dollars.

While exact timing to a “normalized” state is uncertain, a 9x consensus 2024 EBITDA entry point provides an attractive risk/reward opportunity for a defensive company with favorable secular tailwinds, a differentiated product offering, and ample whitespace to compound EPS at a mid-teens rate.

As these headwinds subside and GO digests its recent acquisition, organic unit growth recovers to high single digits (HSD) and comps settle in the low single digits (LSD) to combine for 10% topline growth. Assuming only de minimis EBITDA margin improvement, a 10x 2026 exit multiple nets a $29.50 share price, 20% 3-year IRR, half a turn of deleverage, all with considerable room for further growth.

Background

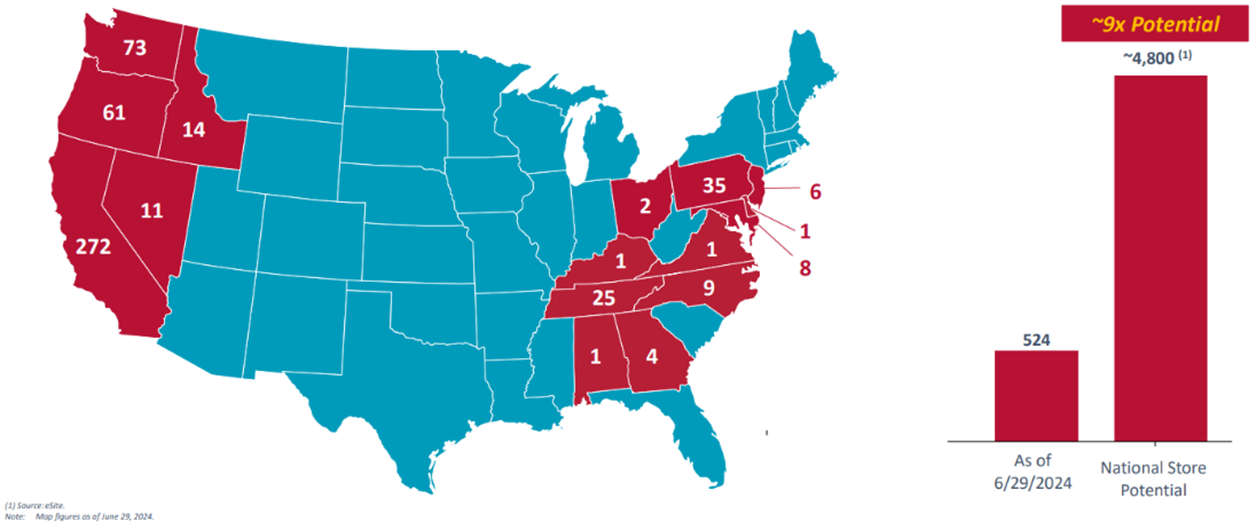

Grocery Outlet is a discount retail grocer with over 520 stores primarily in the Western and Northeastern United States. In February, the company acquired 40-unit United Grocery Outlet (UGO), expanding its footprint to the Southeast. Along with providing standard staples and perishables, GO opportunistically sources name-brand products at fire sale prices from suppliers with excess inventories (e.g., from overruns, odd lots, stock approaching sell-by dates, etc.). This lends to a “treasure hunting” shopping experience- one that encourages frequent visitation with an ever-changing assortment of items at prices 40 to 70% below comparable grocers.

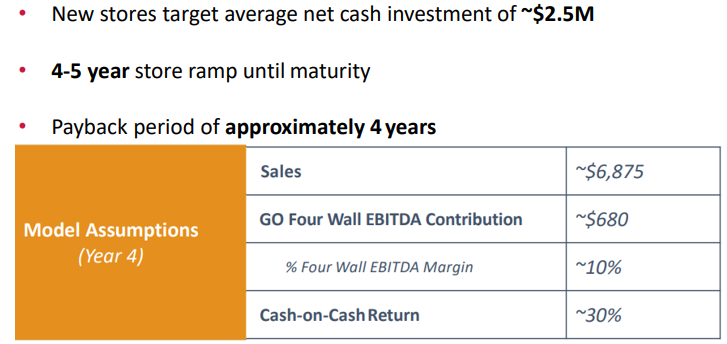

GO operates in a quasi-franchise model (with surprising parallels to Chick-Fil-A) where Independent Operators (IO) are responsible for managing the ordering, merchandising, marketing, maintenance, and staffing of their respective store. Unlike a traditional franchise, GO leases the real estate, funds the initial store build out (with some working capital provided by the IO), and sells inventory (selected by the IO) on a consignment basis. In turn, GO splits store level gross profits 50-50 with the IO. Substantially all IOs manage only a single store and many work as two-person (often spousal) teams.

The company believes it can ultimately operate 4,800 stores and targets 10% annual new unit growth. However, growth has been depressed over the past two years due to construction issues, permitting delays, and labor shortages.

Short Term Headwinds

GO is facing two acute challenges:

ERP Implementation: In August 2023, GO began modernizing its internal technology systems. These transitions are seldom painless, and GO’s was no exception. Through Q2 2024, the disruption led to issues with payment processing, ordering, inventory management, store level reporting, and warehouse shrink- compressing margins and EBITDA dollars. However, when adjusting for the estimated negative impact of the upgrade, gross margins remain healthy and in line with recent history.

As with many companies undergoing an ERP overhaul, Grocery Outlet was far too sanguine regarding the number of unforeseen problems, and how quickly those problems could be resolved. But, after a FY 2024 guide cut in Q1 and positive (yet sober) management commentary on the process, GO seems to finally be turning a corner. Of note, even the lawyers co-signed this optimism:

Q1 10-Q: “…disruptions are still ongoing as of the date of this filing and are expected to have negative impacts on our results of operations into (H2 ’24).”

Q2 10-Q: “…we do not expect any further disruptions that would result in material negative impacts on our results of operations in (H2 ’24).”

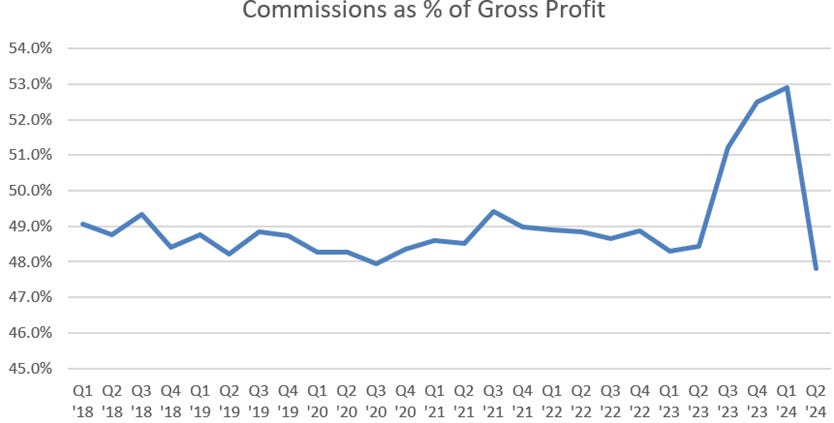

To offset the ERP disruption, beginning in Q3 2023, GO provided additional commission relief, allowing IOs to take a larger share than the typical (roughly) 50% of gross profit. This support ended in March 2024 and commission percentage share (an inverse take-rate) has returned to normal levels.

Even assuming some continued adverse effects into Q3, margins have begun to recover and the episode is immaterial to the medium (much less, long) term prospects of the business.

Weak New Units’ Performance Suggests Limited TAM: Since early 2023, GO’s new store growth slowed to around 6%, well below its 10% target rate. Management attributes this to the previously mentioned shortages/delays plaguing the building sector in the post-COVID world.

In contrast to GO’s positive, but terse commentary on the state of new IOs, skeptics have argued unit deceleration is due to poor performance in more recent store vintages, indicating that GO’s realistic unit count is far lower than the purported 4,800 locations. These critics cite the growth of GO’s Temporary Commission Adjustment Program (TCAP)- effectively a financial assistance scheme for IOs- as evidence that, as new stores are opened, Grocery Outlet corporate must increasingly prop up these (allegedly) uneconomical units.

While TCAP has been growing since late 2020, the rate of growth has recently plateaued and turned negative in Q2 2024. Total loans outstanding (which includes TCAP, non-distressed working capital financing, and new store financing) to IOs as a percentage of trailing sales have also reverted to long term historical averages.

Acknowledging TCAP remains elevated and that recent IO cohorts may currently be over-reliant on GO corporate, trends are turning positive (less support needed per dollar of sales) and absolute loan amounts are not out of line: TCAP is not a smoking gun indictment of Grocery Outlet’s longer term growth potential.

Confidence in GO’s Growth Trajectory

Secular Tailwinds: Though discount grocers (including superstores, warehouse clubs, and dollar stores) had become increasingly popular prior the recent bout of inflation, rising food prices unsurprisingly accelerated consumers’ shift towards these lower cost options. Understanding estimates vary, discounters are expected to grow at 3 to 4%- twice the rate of traditional grocery- implying continued share gains. For a recent, confirmatory anecdote: in March, German discounter Aldi, announced a $9B plan to add 800 stores (25%) by 2028.

Competition: GO lacks Walmart’s, Costco’s, or Aldi’s scale, raw efficiency, and corresponding ability to compete on cost. However, Grocery Outlet’s unique “treasure hunt”, rotating assortment of name-brand items offers a differentiated experience for shoppers. The company recently launched its own private label offering: adding margin accretive products as well making GO a more viable “whole shop” option with a predictable, consistent array of staples (e.g., pet, home, self-care SKUs).

Multiple Levers: The company has seldom engaged in M&A (the last deal being an expansion to the east coast with the 2011 purchase of Pennsylvania-based, 13-unit Amelia's), preferring to add a handful of new units each quarter in or around existing operating regions. So, the UGO acquisition, including a distribution center/procurement infrastructure with capacity to support additional stores, presents a notable new geographic leg of growth in the Southeast. Any other immediate M&A is unlikely while integration is underway, but if organic expansion falters, the company is able and willing to explore external options.

To speculate- GO has so far stuck with its single-store, single-IO model. However, at a larger scale, permitting multi-unit IOs could allow for faster growth given these institutionalized operators may have easier access to working capital financing, labor resources/training, and store best-practices. On a much longer-term horizon, a full franchise (percentage of revenue take) approach- perhaps experimented with first in an international setting- could be the next step to unlock considerable value.

Other Considerations (Reading Management Tea Leaves)

Grocery Outlet’s longtime CFO stepped down amicably in March (after the Q4 call) and the company is currently searching for a replacement. While the absence of a CFO carries its own set of problems, there may be some near term derisking as the interim CFO ripped the band aid by cutting the FY 2024 guide on her first call (Q1) and held it mostly constant in Q2. If a new CFO is selected prior to Q3 earnings, it is possible, but unlikely, there could be further cuts. Moreover, guidance nitpicking of course would not immediately discredit the multi-year thesis.

Valuation

Topline growth accelerates from HSD to approximately 10%, as ERP issues roll off, sales per store inflect positive, and the company digests the UGO acquisition before slowly returning to its targeted 10% new unit cadence.

After several quarters above 31%*, gross margins normalize at 30.5% and IO take rate reverts to its historical level of just under 50%. EBITDA margins return to the low 6% range.

*GO CEO & Interim CFO, Q2 2024 earnings:

“In an effort to return the business to healthy margins, we over-indexed in some instances to price, which impacted customer value… as we (made) these adjustments, we experienced increases in promotional and pricing activities from key competitors, putting further pressure on our relative value… although we have some higher margins (we achieved in Q2) and (guiding for Q3)… 30.5% is definitely reflective of the healthy (gross) margin (for FY 2024 and) long term for the company.

Barring any unforeseen major expansions or renovations, capex steps down in 2025, FCF turns positive, and the company slowly delevers while using buybacks to manage or reduce its share count (GO hastened its buyback following the Q1 earnings sell off, repurchasing 1% of its FD SO in Q2), GAAP EPS doubles with a mid-to high-teens exit rate into 2027 and beyond.

Applying a 10x multiple on $320M of 2026 EBITDA nets a share price of $29.50 for a 20%+ IRR.

Bottom Line: GO’s recent stumbles do not compromise the company’s long-term 10% topline, mid-teens EPS growth algorithm. As these disruptions clear, GO is well positioned to expand and thrive, even in the highly competitive discount grocer space. Regardless of the exact time until normalization, paying 9x 2024 EBITDA for a profitable, self-financing, consumer staple with a decade-plus of growth runway seems a compelling risk/reward opportunity.

Risks

Though discount grocers have begun attracting more well-off shoppers, GO is not necessarily the lowest priced option and still has considerable exposure to economically sensitive, low-income consumers. In the event of a broader downturn, it is unclear if gains from (higher income) consumer trade-down would be enough to offset the lost low-income cohorts.

GO’s growth is predicated on hiring competent IOs to manage its stores. If new vintages turn out to be impaired (or there is a popular enough perception that they are), then successfully courting new IOs may be difficult.

At a certain size, Grocery Outlet may run out of product to source- CPGs only produce so much excess (read: errant) inventory and are certainly not in the business of matching GO’s demand. So far, this has not been an issue and there is likely some respite from competitive sourcing given dollar stores’ recent pullbacks / bankruptcy. The company also managed well enough during the early COVID period’s surge in demand for grocery items.

This could have been written by an AI program as it shows little depth of understanding of GO's hybrid distribution - retail model or its fundamental issues -1. failure of the infill / zero canibalization model & existance of 40+ underperforming stores that need closure 2. High churn & declining IO income below sustainable levels 3. Closeout supply ceiling which limits growth to 700-800 locations. 4. Non commission GO solution to uneconomic stores - give it to an existing IO. However, the format is nice but with no depth of understanding of the business. Junk Research.

Thanks, great write up.